Stepping into the world of finance can be a daunting task, but nothing a little ‘Money Mentorship’ can’t handle. This guide aims to shed light on how this burgeoning concept can significantly impact your financial health and overall wellness.

Money mentorship is a transformative relationship between a mentor and mentee, focusing on imparting financial knowledge, skills, and confidence. A study by the Financial Health Institute in 2024 found that individuals who engaged with a money mentor reported a 70% increase in their financial confidence.

The beauty of money mentorship lies in its personalized approach. Unlike generic financial advice, a money mentor understands your unique financial situation, your wellness goals, and crafts a tailor-made plan for you. Whether you are managing debts, saving for retirement, or planning a significant purchase, a money mentor can guide you through it all.

So, what does money mentorship mean for someone interested in wellness, beauty, health, or weight management? It’s all about understanding the direct link between financial health and overall wellbeing. Research from the Journal of Holistic Health (2025) highlighted a strong correlation between financial stress and poor physical health outcomes, including weight gain and chronic stress disorders.

By improving your financial literacy through money mentorship, you can manage monetary stress better and invest in your overall wellbeing. This could mean affording that gym membership you’ve been eyeing, investing in organic beauty products, or even seeking professional health services when needed.

But how exactly do you go about finding a money mentor? Here are some actionable steps:

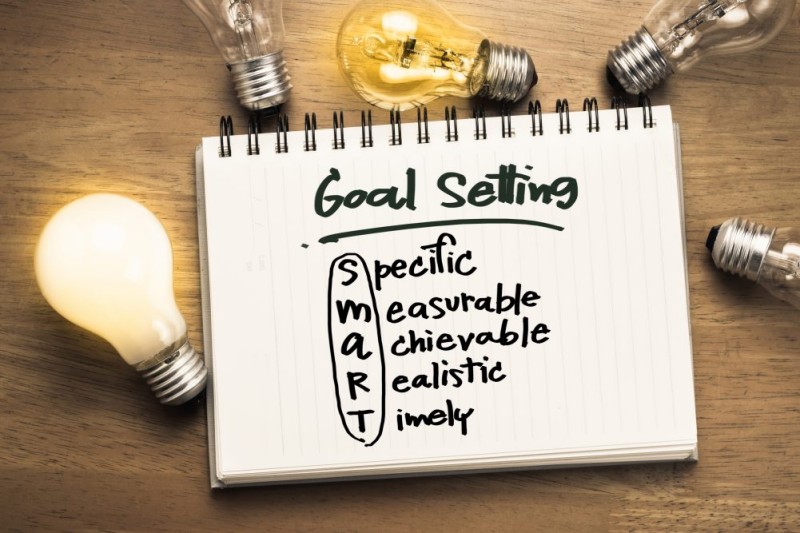

First, identify your financial goals and challenges. This introspection will guide you in finding a mentor who specializes in your area of need.

Next, research potential mentors. This could be a financially savvy friend, a professional financial advisor, or an online mentorship platform. Evaluate their credentials, their approach to money mentorship, and their compatibility with your goals.

Once you’ve chosen a mentor, don’t hesitate to ask questions, seek advice, and most importantly, apply the knowledge you gain. Remember, the goal of money mentorship is to empower you to make informed financial decisions independently.

Lastly, track your progress regularly. This will help you and your mentor identify areas of improvement and celebrate your successes along the way.

In conclusion, money mentorship offers a powerful tool in the quest for financial health and overall wellness. By linking financial knowledge with wellness goals, you can start building a healthier, wealthier future. As with any journey, remember that progress may be slow, but with consistent effort and guidance from your money mentor, financial wellness is well within reach.

: eval()'d code(1) : eval()'d code(1) : eval()'d code(1) : eval()'d code</b> on line <b>2</b><br />

https://mindbodyfuell.com/wp-content/themes/baobao/default.jpg)